can you pawn a car title without the car

Understanding Car Title Loans: Answers to Common Questions

Question 1: What is a car title loan?

A car title loan is a type of loan where the borrower uses their car title as collateral. It allows individuals to access quick cash by borrowing against the value of their vehicle.

Question 2: How do car title loans work?

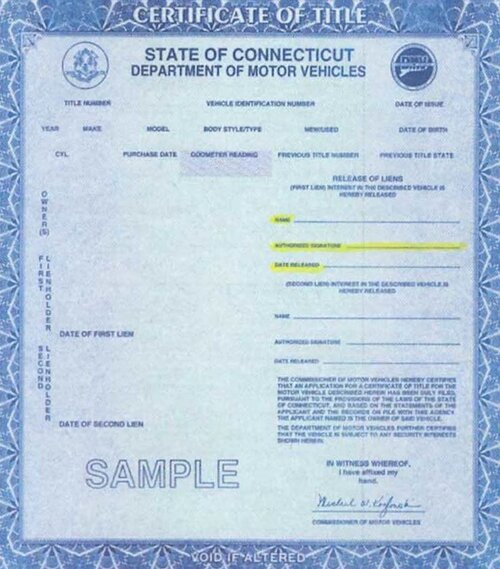

Car title loans typically involve the borrower surrendering their car title to the lender in exchange for a loan amount. The lender places a lien on the vehicle, and once the loan is repaid, the lien is removed. If the borrower fails to repay the loan, the lender may repossess the vehicle to recoup their losses.

Question 3: What are the eligibility criteria for a car title loan?

The eligibility criteria for a car title loan may vary depending on the lender. However, common requirements include:

- Ownership of a fully-paid or nearly fully-paid vehicle

- Valid identification and proof of income

- Minimum age requirement (usually 18 years or older)

- Residency in a specific state or region

Question 4: How much can I borrow with a car title loan?

The loan amount you can borrow with a car title loan depends on various factors such as the value of your vehicle, the lender's policies, and your repayment ability. Typically, car title loans range from a few hundred to a few thousand dollars.

Question 5: Can I get a car title loan without a job?

Some lenders may provide car title loans to individuals without a traditional job. However, alternative sources of income or collateral may be required to demonstrate the ability to repay the loan.

Question 6: What are the interest rates and fees associated with car title loans?

Interest rates and fees for car title loans can vary significantly depending on the lender and the state regulations. It is crucial to carefully review the terms and conditions of the loan agreement to understand the applicable rates, fees, and any potential penalties for late payments or defaults.

Question 7: How long do I have to repay a car title loan?

The repayment period for car title loans is typically shorter compared to traditional loans. It can range from a few weeks to a few months. The specific term will be outlined in the loan agreement.

Question 8: Are car title loans safe?

While car title loans can be a convenient option for accessing quick cash, they also come with risks. It is crucial to work with reputable lenders and carefully consider the terms and conditions before entering into a car title loan agreement.

Question 9: What happens if I am unable to repay the car title loan?

If you are unable to repay the car title loan as agreed, the lender may repossess your vehicle to recover their losses. It is essential to communicate with the lender if you are facing difficulties and explore possible alternatives such as refinancing or negotiating a repayment plan.

Question 10: Can I still use my car while I have a car title loan?

In most cases, you can continue using your car while you have a car title loan. However, the lender will hold the title as collateral, and they may have the right to repossess the vehicle if you default on the loan.

Question 11: Are there alternatives to car title loans?

Yes, there are alternative options to consider if you need quick cash. Some alternatives include:

- Personal loans from traditional banks or credit unions

- Credit card cash advances

- Borrowing from friends or family

- Exploring local community assistance programs

Question 12: How can I choose a reputable car title loan lender?

When selecting a car title loan lender, consider the following factors:

- Research and compare multiple lenders to find competitive rates and terms

- Check customer reviews and ratings

- Ensure the lender is licensed and regulated

- Review the loan agreement carefully and seek clarification on any unclear terms